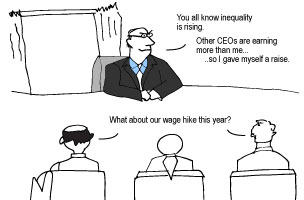

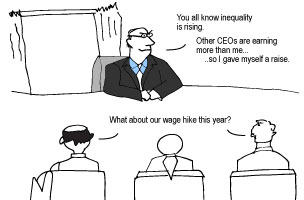

The richest 1% in India cornering 73% of the wealth generated in the country last year, according to the 2018 Oxfam report, Reward Work, Not Wealth, after over 25 years of liberalization raises a few basic questions. The report also showed that the wealth of India’s richest 1% increased by over Rs. 20.9 trillion during 2017—an amount equivalent to total budget of the central government in 2017-18.

This outcome can be read in two ways: one, that the rich have disproportionately benefited from the policies for liberalisation and the poor could not and two, that liberalisation itself creates this inequality.

If we take the first proposition to be true as most people do, the understanding that our policymakers provide is that with slight adjustments in policy which remove the barriers for market forces, all problems will get automatically fixed. The problems that we have today, such as this rising inequality, are ‘short term hiccups’ that will get resolved when we allow the market forces to function unfettered. This is why our governments across the world are competing against each other in removing the barriers to market forces such as existing labour laws, government controls and regulatory institutions. Liberalisation means Progressive Elimination of Government Controls, Progressive Cuts in Social Spending, Increased Labour Market Flexibility, Privatisation of the Public Sector and Progressive Rationalisation of Tax structure thereby promoting growth led by the private sector.

Question 1: Have these policies measures led to growth?

After over 25 years from the first phase of liberalisation, our policymakers boast of India being one of the fastest growing economies in the world, placed only after China. In 2017, China’s GDP growth rate of 6.8% and India’s 6.7% demonstrate a common pattern of growth which is in sharp variance with the slow growing economies in the global north. Rapidly growing state investment has played a significant role in China and India’s economic expansion, while private investment has either grown very slowly like in the global north or actually declined. According to an analysis the year-on-year increase of India’s government investment was 21 percent while private investment actually fell by 1.4 percent (2015). The efforts of the Modi government to boost investments in the manufacturing sector through the Make in India programme failed to bear fruit. Unfortunately, private investment remains sluggish and could even derail India’s growth story. Thus the growth figures are not certainly an outcome of the liberalisation policies. What liberalisation has certainly done is that it has transferred public resources for the development of the private sector and thereby forcing a cut in the social spending.

Question 2: If these policies have not triggered growth, have they ensured the distribution of the benefits of this growth?

Here, in this context, let us look at some of the broad policy initiatives that constitute the neo-liberal policy framework and how they have impacted the economy.

Progressive elimination of government controls: From delicensing in the 1990s to the recently instituted FDI reforms, initiatives for quick approvals and clearances, self-certifications, bringing in the insolvency and bankruptcy code have all created an environment where capital is unregulated in most cases. The responsibility of the government to regulate businesses to ensure safety and security of workers engaged in these establishments as well as to ensure that citizen consumers are protected against malpractices of these businesses, has today been mostly foregone, which leaves the large majority of people in the economy exposed to market forces. Let us take the example of bottled drinking water. When government announced that bottled water can only be charged at printed price, most companies launched new packaged drinking water that costs several times more than regular bottled drinking water. There is an understanding between rival corporates to raise the price of the product, because of which they both gain but continue to battle over market share through product differentiation (making claims that their water is from hot springs or from the Himalayas etc.), but the only entity that loses entirely are the common people. This can be true for all commodities, whether goods or services such as bank charges charged by private banks or charges for not maintaining minimum balance by even public sector banks.

Cuts in Social Spending: Proportion of government expenditure on education, health to GDP or budgetary expenditure has remained at best stagnant over the years. World Bank data shows that public health expenditure in India at 1.4% of GDP in 2014 is much lower than the world average of 6%, Brazil at 3.8%, Russian Federation at 3.7% and China at 3.1%, among others. In the case of education, in 2015-16, India spent 3% of its GDP, compared to 3.8% in Russia, 4.2% in China, 5.2% in Brazil and 6.9% in South Africa. In 2016-17, India’s budgetary expenditure on health and on education is still hovering around 1.3 % and below 4% of the GDP respectively. To make matters worse, the Niti Aayog is pushing for a greater role for private players in healthcare. 85% of the total out-of-pocket-expenditure on health in the country is spent on private facilities. One of the major reasons that India’s poor incur debt is the cost of health care.

The continuous effort to replace the public distribution system with targeted cash transfer and to freeze the minimum support price for agricultural commodities has together created a condition of unsustainable lack of access to food for both rural and urban poor.

In addition to this is the effort by the government to eliminate all forms of reservation for SCs and STs in government employments. The rationalisation of the Group D and the progressive contractualisation of jobs traditionally accessed by these communities has further aggravated the inequality.

In the 20th century, public spending and progressive taxation were aimed at bridging the gap of access to basic social indicators between the rich and the poor and creating opportunities. But come liberalisation, there has been a shift in the basic principle where we now hear from our policymakers that extreme inequality of income and wealth doesn’t really matter provided we all get a decent opportunity to succeed. It is more to do with our individual capacity to succeed that matters and not where we started. So the key to success lies with us and our efforts and merit and not the conditions where we started. Thus a daughter of a dalit safai worker, if given the same opportunity as the son of an upper caste government employee should be able to get to the same place without any additional support for her. While this sounds perfect and many of us would like to believe that this is what equality should look like, unfortunately this fails to reflect reality. This principle ignores that fact that fortune of birth is directly linked to the fortunes of our parents – conferring lifelong advantages on some for historical social, cultural and economic reasons, while relegating others to a lifetime of trying to keep up. Well-being of a certain group of people arises from a combination of what they have, what they can do with what they have, and what are the social and cultural barriers to being able to do what they think they can.

Hence if we go back to the initial questions, liberalisation has contributed to this rising inequality of opportunities and outcome as opposed to what our policymakers suggest that the poor are poor because they don’t try hard enough.