The Code on Wages was one of the first proposals on labour reform in 2015 to be floated by the BJP government soon after coming to power at the centre. Initially the government claimed that the proposed changes were necessary to reflect changes in technology and will create more jobs. The government also claimed that the merging of the four existing laws into one code aimed to eliminate the various contradictions between these existing laws. The Code was introduced in the Lok Sabha in August 2017 but got referred to a Parliamentary Standing Committee. The Code had to be re-introduced and was passed in both houses of the parliament in August 2019. It received presidential assent and was gazetted on 8 August 2019. The Code on Wages is now a law – a law that repeals the earlier Payment of Wages Act, 1936, the Minimum Wages Act, 1948, the Payment of Bonus Act, 1965 and the Equal Remuneration Act, 1976.

Why do we need Labour ‘Reform’?

India’s ‘inflexible’ labour laws have been blamed for almost everything that has ever gone wrong in the economy. Yet there are two issues with the labour laws that raises questions on this:

(i) How many workers do these laws actually cover?

According to government estimate over 92% of workers in the country are NOT covered by these labour laws. So how do these laws act as barriers to investors?

(ii) How stringently are these laws implemented where they do apply?

In sectors and industries where there are strong unions, the laws may work to some extent. But over the years unions have lost their strength with large scale precarisation in all unionised sectors and thus implementation of the laws have become merely an aspiration of the struggles.

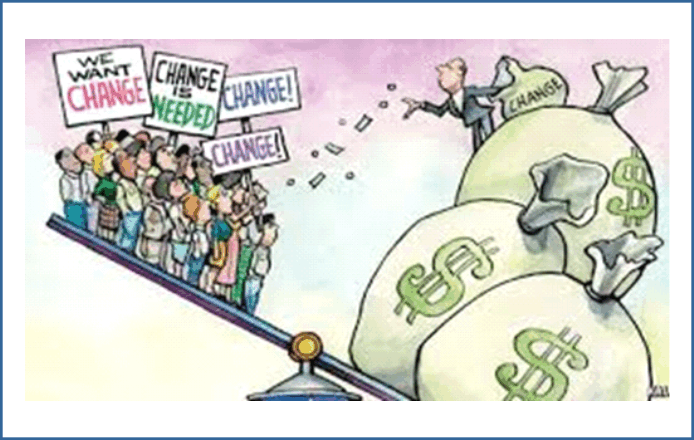

So then, why do we still need these new labour codes when they were already not working?

The new Codes aim to create a system where the gains of collective struggles are wiped out. It aspires to promote a system where every worker is individualised and they are forced to negotiate their conditions of work at an individual level. Thus labour ‘reform’ is not simply to cut costs for employers, it is to further skew the balance of power between labour and capital, it is to change how working people view ‘rights’ in the future. Thus the attack is not just to take away rights that exist, it is to erase any possibility of seeking rights in future.

The story of aspiration woven by the proponents of a neo-liberal world stresses on aspirations that can be fulfilled with individual effort, on removal of institutional barriers that prevent individuals from reaching the unreachable. This narrative of individual success does not reveal the probability of success of every individual. It does not reveal the thousands of stories of failure, of unemployment, of poverty, of intergenerational misery that are shoved under the carpet of one success story. This is an effort to review the Code on Wages from the perspective of the many, and not the few. The many who will get left behind, who will be pushed to poverty wages, who will not be able to afford education for their children, healthcare for their family, care for their ageing parents, who will not have enough to save for their own old age.

Code on Wage – Wiping away Aspirations

Applicability: You Can’t Fool All the People All the Time

Myth 1: The Minister for Labour and Employment while introducing this legislation stated that the existing wage legislations only covered about 40% of the workforce (quoting an ILO report) who were included in scheduled employments but this historic code will benefit about 50 crores of workers. He specifically claimed that this code will ‘especially include workers in the informal sector like agricultural workers, those who push carts, head loaders, mothers and sisters who work as domestic workers, guards who protect our neighbourhoods’ for the first time.

Reality: Agricultural work has been a scheduled employment in most states, headloaders and construction workers have not only been scheduled employments, they had sector specific welfare boards for social security which they won through long militant struggles, domestic worker is also scheduled employment in many states now.

In addition, in states where agricultural workers and domestic workers were included in the schedule of employment, there were no restrictions on their eligibility to minimum wages under the old law. What the code on wages has put in place is that domestic workers and agricultural workers are covered by the code only if their employer employs more than 5 workers! How many employers in this country employ domestic workers? And how many of them hire more than 5 workers? The issue of domestic workers for the longest period has been that they are employed ubiquitously by even the higher end working class and thus it is extremely difficult to build solidarity with other sections of the working people in their struggle. This makes it clear that even a worker in a factory often is an employer for a domestic worker. Thus regulation of working conditions of domestic workers is a severely contentious issue even within trade unions.

The Wage Code for the first time restricts the applicability of a wage law to the number of workers employed in an establishment. In the case of agricultural workers as well, the largest number of agricultural workers in our country are employed in farms which employ less than 5 agricultural workers. Thus the new law in reality excludes the largest majority of agricultural workers and domestic workers.

Besides it also excludes all workers under the various government flagship schemes like the Anganwadi workers, ASHA workers, ANMs, Mid-day meal workers despite the recommendation of the 45th session of the Indian Labour Conference. And finally it also excludes the NREGA workers who according to the original act were supposed to be paid the prevailing agricultural wage in the state for its projects. With the implementation of the NREGA in rural areas, prevailing wages in agricultural work increased considerably. This was met by opposition from medium and large landholders. The Code now excludes NREGA from the minimum wage legislation claiming that work under NREGA is not work!

Regulation and Violation

The Labour Minister claimed that the minimum wages act could not be applied to all workers. Was it because the law was inapplicable or was it because of lack of political will? These questions are critical to ponder over when certain laws are replaced by others to ensure expansion of the reach and increased efficacy.

The minimum wage act and the payment of wages act had certain provisions in place through its mechanism of penalties, including imprisonment, which made violation of its provisions, a criminal offense. This has been vehemently opposed by employers for years.

The new Code takes away the teeth of both these laws. It limits the power of the labour inspectors who were empowered to conduct inspections and punish the violators and converts them into ‘facilitators’ to make sure employer interest is protected. Under the new code Labour inspectors will have to inform the employer of their visit before they come and can only visit with the permission of the employer. The experience in the garment industry across Asia is proof enough of how inspections work when employers are aware of the visits. Factories are cleaned up, workers are threatened with dire consequences before an inspection rendering the entire exercise of inspection and audit futile. Rana Plaza in Bangladesh was certified as safe by an international audit company months before it collapsed and killed thousands. This is a clear violation of ILO Convention 81 on Labour Inspection that was ratified by India in 1949. Article 12 of this Convention states that “Labour inspectors … shall be empowered: (a) to enter freely and without previous notice at any hour of the day or night any workplace liable to inspection”.

The non-implementation of the act is blamed on multiple and conflicting definitions and provisions of these laws. The new code has definitely not eliminated the so called multiple definitions, in fact it has created more confusion than existed earlier. The Code has created confusing definitions of working people to be covered by it – workers and employees, of wages – minimum wage and floor wage, along with an entire structure for arbitrary determination of hours of work in a normal working day, time of revision of wages, determination of minimum wage and floor wage.

Rendering the labour inspectors powerless to conduct independent random enquiries and take immediate action against violators is proof enough to show the intent of the code. Though the code claims to promote inclusivity, in reality it is a smokescreen for allowing violation of minimum wage with impunity. The code even takes away the threat of imprisonment for first time violators. In the name of extending minimum wages to all, the code creates a legal structure for non-payment of minimum wages to workers in all sectors, not just the informal sectors.

Employer Accountability

The Wage Code, contrary to existing law on contract labour, absolves the principal employers from all responsibility for payment of minimum wages, for payment of equal wages for equal work, for delayed wage payment by contractors.

A worker employed at the grand Manesar factory of Suzuki producing the highest end cars for the super-rich, if is hired through a local contractor, the contractor shall be responsible for his conditions of work and not Suzuki. Intermediaries (Contractors) are created by the principal employer so they can squeeze the workers without spoiling their own name. Contracts are given out to the intermediaries through a bidding system: lower the bid, higher the chances for the contractor to get the contract. In such a situation, a contractor is forced to pay a low wage, sometimes even lower than the minimum wage, because the cost of the contract set by the company is too low to afford a higher wage. Thus the primary responsibility for the low wage rests with the company floating the contract and not the contractor who pays it. These contracts could be, by law, earlier proven to be sham and bogus contracts. The Code on Wages legalises such contracts.

Capacity to Pay as Determinant of Wage

The schedule of minimum wages was replaced by a standardised rates of minimum wage based on skill levels irrespective of sectors in the state of Delhi. This was a step towards universalisation of the applicability of the minimum wages act. The new code has pushed us back to a regime where the central government will have the power to decide minimum wages for different sectors based on skill of workers or the geographical area where they are working in or both, on the arduousness of the work, on the hazards and if it is underground work on its own. While these parameters seem reasonable, the tripartite nature of determining the wages and negotiating these factors has been done away with along with the 15th ILC norms in conjunction with the Reptakos Bret and Unichoy orders of the Supreme Court.

In the present socio-political and economic circumstance, it does not require very high intelligence to understand how these wages would now be determined. In low value addition sectors such as garments, in the states of both Karnataka and Tamil Nadu, employers have over the last two decades delayed revision of wages, and implementation of revised wages through legal action, on the plea of incapacity to pay. This has also been the case in the tea industry in West Bengal and Assam despite both states producing much higher quality tea than Tamil Nadu or Kerala. This will now become the norm, not the exception. The capacity of employers to pay will take precedence over workers’ ability to survive on the minimum wage. While employers’ capacity to pay was considered irrelevant by the Supreme Court, through the new code, this will become the bottom line for determining the minimum wage with no available tripartite space for trade unions to voice their opposition and negotiate for the workers.

Concentration of Power

This code concentrates power in the hands of the central government, in spite of the fact that labour is in the concurrent list of the constitution. The Code makes it clear that the states will no longer have the right to decide on basic elements of the minimum wages act:

- Number of hours of work that constitute a Normal Working Day: May Day is celebrated every year across the world in memory of the struggle for an 8-hour working day. Over hundred years later workers are being pushed to a time where a ‘normal working day’ will have to be redefined. The central government will be the agency to determine the length of a normal working day.

- Period of Revision of minimum wages: The central Government will also be the agency that will determine the period for revision of minimum wages for specific sectors. This again as stated earlier would critically rely on employers’ capacity to pay. The experience of the private sector collective bargaining process is that employers always try to increase the period of revision of wages so that industrial peace is maintained for a longer period of time through the agreement. This obviously is against the interest of workers whose bargained wage gets eroded over time through inflation. Again in the tea plantation sector in West Bengal and Assam, the experience is that employers try their best to drag out the negotiations for wage revision beyond the 5 year norm pushing down real wages further. The removal of the 5 year norm from the law and placing it within the power of the central government to fix will only benefit employers.

- Norms of Determining Minimum Wage: The 15th ILC norms along with the subsequent Supreme Court orders in the cases of Reptakos Bret and Unichoy had become a standard measure for determining minimum wage in the country. A new law should have attempted to codify it. Instead the new code gives the Central government the power to determine the minimum wage. The central government, according to the Code, may or may not consult trade unions in determining this wage. It may appoint a committee that will review wage fixation and thereby publish the wage proposal by notification for the information of those affected. (The government appointed a Committee for determining the floor wage. The committee recommended Rs 375. The government fixed it at Rs 178 and provided no explanation for its decision!)

This is a clear breakdown of the tripartite process of negotiation for wages. Workers organisations and trade unions are no longer important decision makers in the process of wage setting. This law also undermines trade unions and their right to represent workers in tripartite bodies. Thus this is not just a law on wages, it is a law to bypass the trade unions.

Floor Wage = Forced Labour

The understanding that the statutory minimum wage is the minimum that a wage can be set at is challenged by the new Wage Code. The code establishes a wage that can be even lower than the statutory minimum wage and this will be called the Floor Wage. According to several Supreme Court orders, non-payment of minimum wage is considered to be forced labour. Article 23 of the Constitution prohibits forced labour. Thus a floor wage is in violation not just of the Supreme Court orders but also of the Constitution.

The minimum and the floor wage together also create a legal anomaly – should employers pay the minimum wage or the floor wage to avoid penalty? The code states two things: (i) violation of minimum wage will attract a monetary penalty; and simultaneously (2) wage paid cannot be lower than the floor wage. So if an employer does not pay the minimum wage but pays the floor wage or more, the employer can escape even the monetary penalty. If this is the case, why would any employer pay its employees the minimum wage? The announcement of such a floor wage creates a race to the bottom.

This race to the bottom will not just lead to stagnation of wages in most sectors, it will also lead to large scale migration of workers from regions/sectors of low wage to regions/sectors of relatively higher wages. This in turn will create a desperate pool of migrant workers who are willing to work for small increases in wage under much more hazardous conditions of work than what local workers are willing to do leading to conflicts between local and migrant workforce. This division among workers works in the interest of the employers who are then able to pitch one section of workers against another and push the general level of wages and conditions of work lower.

Equal Remuneration*

The Equal Remuneration Act, 1976 clearly stated that no employer could discriminate between workers on the basis of gender in (i) payment of remuneration for same or similar work; (ii) in recruitment and (iii) in promotion, without any conditions.

The Wage Code now qualifies how same and similar work performed by men and women can be defined. Similarity of work will be determined with (i) level of skill, (ii) effort required to perform a certain task, (iii) experience in the job, and (iv) responsibility in the job. In a male dominated work environment, in over four decades of the earlier legislation in place women and trans workers have struggled to climb the wage and skill ladder. This new conditional law will make it impossible for women and trans-workers to earn equal to their male counterparts. The change in law in fact will make it easier for employers to employ women and trans-workers for less citing flimsy grounds on the basis of these conditions.

* Conditions Apply

Bonus: Take it or Leave it

Finally, the Bonus Act provided workers and their organisations the right to access company financial documents on the basis of which bonus would be calculated and negotiated in the organised private sector. It was the power of trade unions that determined how much bonus a union could bargain for its members based on the profit earned by the company. This was possible only because companies, according to the bonus act, were required to disclose their financial documents to trade unions for the negotiation.

The Wage Code makes disclosure non-mandatory for employers thereby crumbling the entire premise of negotiation for bonus. If a union has no access to documents, it has no basis for demanding any bonus. It has to rely on the word of mouth of the employer and their audited accounts, which cannot be questioned, for any calculation. Seeking legal recourse will also not achieve much as the courts are also not allowed to disclose the financial documents to the trade unions unless permitted by the employer. Under the Code, workers will either have to accept the bonus that the company is offering or let it go. There is no other way.

Code on Wages: It Matters!

The Code on Wages is a law that is aimed to make it easier for the employers to exploit workers without any punitive action. It creates legal scope for allowing discrimination at the workplace on the basis of gender – between men and women and trans workers, on the basis of nature of contract – between regular and contract workers, on the basis of size of establishment – domestic workers and agricultural workers will not be eligible if they work in an establishment that hires less than 5 workers. The code also brings in the universal floor wage that will set the standard for wages – every state and every sector will try to reach that level leading to stagnation in wages and large scale impoverishment and destitution. By eliminating the tripartite process, the code also aims to make trade unions irrelevant. The Code on Wages is not to protect workers, it is law to protect employers.

Our lives begin to end the day we become silent about things that matter.

Martin Luther King Jr.