The employers’ across the country are claiming that wages and hence social security contributions will rise with the implementation of the wage code. The government is also claiming the same. They are simultaneously also claiming that contributions to PF, ESI, bonus etc will also increase because of the increase in the wage.

Let us try and understand what the wage code says which is different from the earlier laws and will this difference increase wages for all workers in reality.

The wage Code gives a very convoluted definition of the base wage which earlier was defined at basic + dearness allowance. According to the code, if the base wage is less than half the sum total of all remunerations, paid to a worker in money terms, taken together, then the difference will be added to the base wage.

What does this very complex statement really mean?

It means the base wage must be at least half the sum of all remunerations taken together, ie. Base wage >= 50% of (basic + DA + all allowances).

This provision is aimed at checking employer tendency to split salary in such a way that the base wage (which was only Basic + DA earlier) is kept low while the money wage rises through increase in allowances. This practice is seen (i) at the highest end of the wage ladder in the high value manufacturing industry where there is strong collective bargaining; and (ii) in a large section of the service sector. But all this happens in sectors where the wage is higher than the minimum wage.

Let us take three concrete examples and see how the calculation will change with the implementation of the code for these different categories of workers.

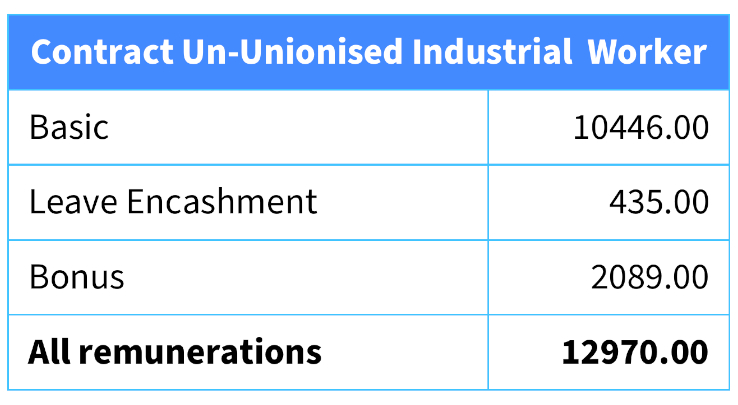

Case 1: Let us first consider the case of a un-unionised contract worker

Base Wage according to original laws

= Basic = 10446.00

50% of all remunerations taken together

= 50% of 12970 = 6485 < 10,446

Hence the base wage will remain unchanged and so will the PF, ESI contributions and bonus calculation. Thus for this worker the implementation of the code will have no impact on his wage and for this company, their cost will not rise in any way.

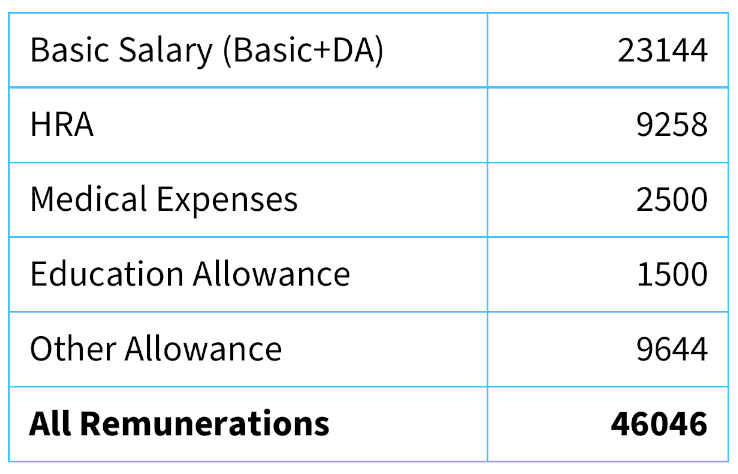

Case 2: Now let us take the case of a permanent industrial worker with a wage higher than the minimum wage but with allowances

Base Wage according to original laws

= Basic salary = 23144

50% of all remunerations taken together

= 50% of 62046 = 23023 < 23144

In this case, too, the implementation of the code on wages will not affect the base wage of the worker.

Case 3: Now let us take the case of a service worker

Base Wage according to original laws= Basic salary = 16417

50% of all remunerations taken together = 50% of 28386

= 14193 < 16417

In this case, too, the implementation of the code on wages will not affect the base wage of the worker.

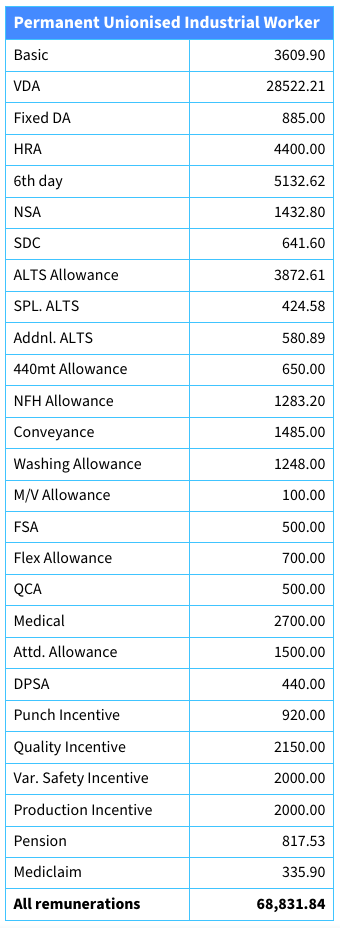

Case 4: Finally let us take the case of a permanent unionised industrial worker, with a wage higher than the minimum wage and with much higher allowances than in the earlier case

Base Wage according to original laws

= Basic + Fixed DA + VDA

= 3609.90+28522.21+885

= 33017.11

50% of all remunerations taken together = 50% of 68831.84

= 34415.92 > 33017.11

According to the Wage Code, the base wage in this case must be at least equal to 34415.92.

Now if we look at the available allowances, to make the base wage at least equal to 34415.92, employers will have to add at least

= 34415.92-33017.11 = 1398.81.

Given the existing wage breakup this can be achieved by

- Add the NSA component to the original wage = 1432.80 OR

- Add Conveyance component to the original wage =1485 OR

- Change the way the allowances are paid so that they can pay only 1398.81 and not more. This will mean re-negotiating the collective bargaining agreement that they have already signed to arrive at this break up.

If we assume that the management of this company would not like to break the collective bargaining agreement, then they must adjust the base wage to either

- 33017.11 + 1432.80 = 34449.91 OR

- 33017.11 + 1485=34502.11, which will also entail a negotiation with the union.

Outcomes in this case,

- Base wage will rise and so will PF contribution, bonus and gratuity.

- Many of these allowances are variable and hence will change every month. This will mean the base wage will also become variable every month (as the total remuneration will be variable). This will in turn mean that the PF contribution etc will also become variable month on month.

- Given this possibility of variability, a worker in this category will now end up working harder to earn more incentives every month to increase their total remuneration and hence their base wage. But simultaneously this will mean higher work intensity and faster burn out for the worker. So even though the worker may earn a higher wage and higher social security, the health cost of this kind of incentive system will also be high.

Who are these workers who will gain from the implementation of the wage code?

According to government figures 98% of the working population is in the unorganised sector. This leaves only 2% in the organised sector. In the organised sector, according to most estimates 1 in every 3 workers is a permanent worker. In many cases this proportion is more skewed. Even if we use this estimate, we are looking at 33% of 2% of the total working population = 0.66% of the workers in this country.

It is this 0.66% of the working population that employers are using to claim that wages will rise and so will PF and other social security contributions if the wage code is implemented.

Employers are opposing the code because this would mean the Cost to Company (CTC) will increase for this high paid section of their permanent workers. Companies are trying their best to convince this tiny section of workers who may benefit from the code, that if the wage code is implemented, their take home salary will reduce as there will be more deductions for PF, etc. Some workers with monthly fixed expenses, such as EMIs on various kinds of loans, etc may find it difficult to survive if their take home pay may decreases, even though their real income will increase. Companies are thus creating a money illusion for this section of the workers so that they too want to stay outside this new norm.

Thus the government and employers’ claim that wages will increase with the implementation of the code is at best 0.66% of the truth.